- Products

- Solutions

- By use case

- By industry

- Pricing

- Resources

- Company

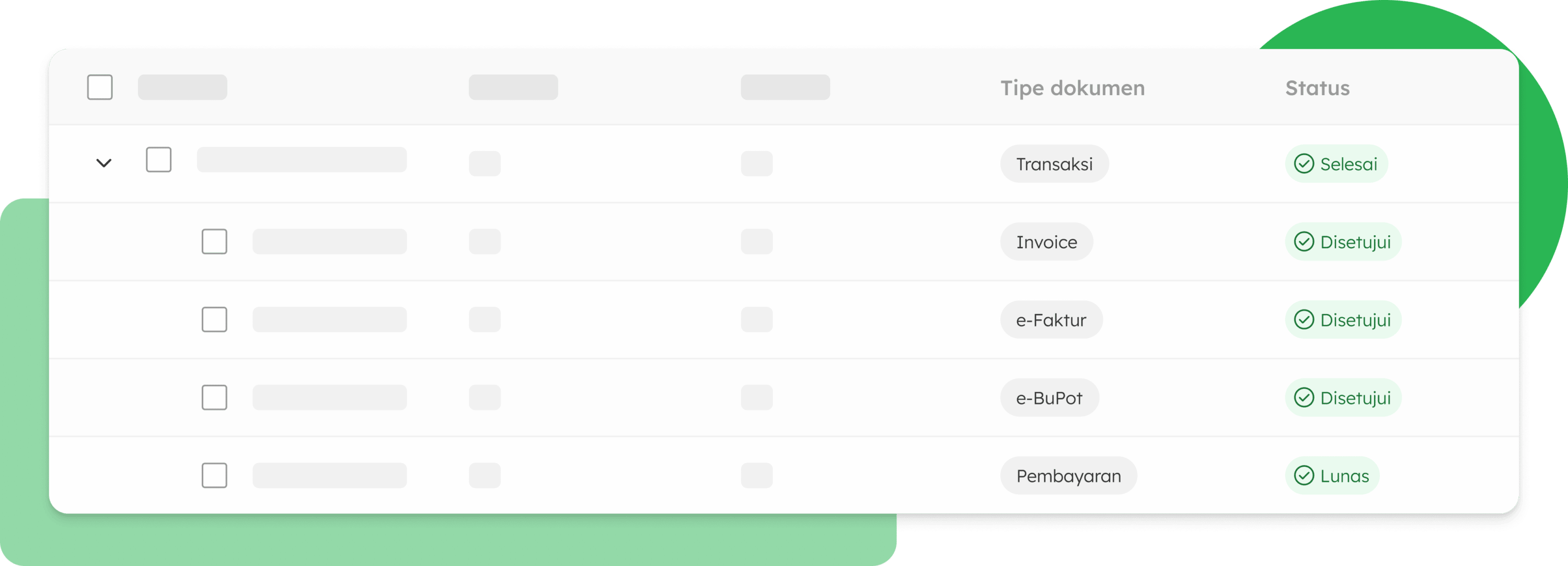

The OnlinePajak Unification e-BuPot service makes it easy to browse invoices and e-Invoices in one integrated platform. With a more accurate process, you can avoid late reporting and the fines that come with it.

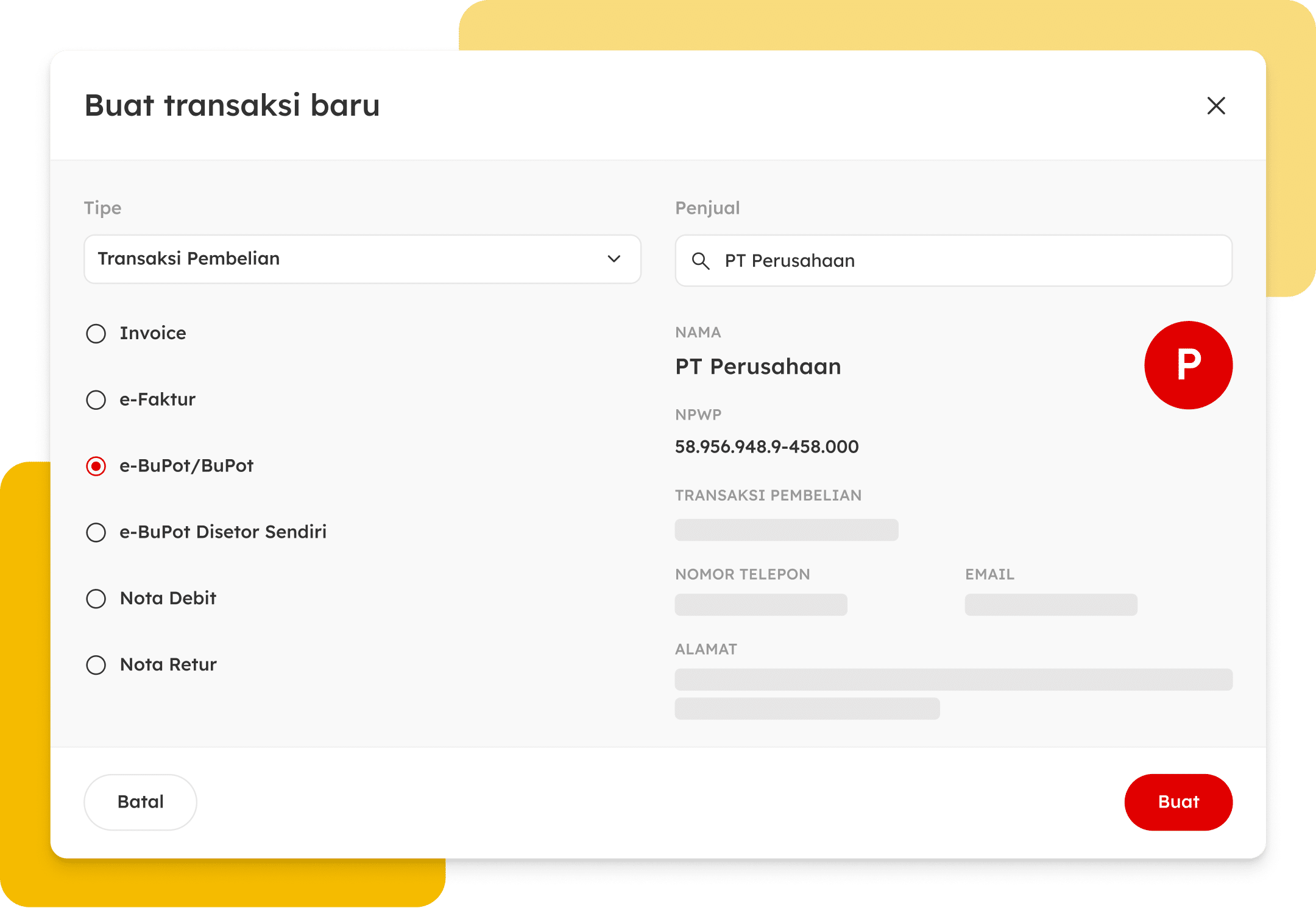

Avoid mistakes in entering transaction counter-party data when creating e-BuPot. Our system allows you to populate the data automatically. You know right away if the data entered is incorrect.

OnlinePajak is an official partner of the Directorate General of Taxes (DJP). The electronic withholding tax receipts you created in OnlinePajak will be synched with the DJP online system.

Please click the “Transaction” menu to create a proof of unification, then complete the information on the counterparty, facilities, and tax objects. Then save and click “Approve” to approve the unification receipt.

Make sure you have done the initial e-BuPot OnlinePajak settings. Then, click the “Transaction” menu to enter the Periodic SPT menu. Select the type of tax you want to report, then click “Post” to post the SPT and proceed with payment. Then, click “Deposit” to input the tax deposit letter.

You can click the “Import” menu on the PPh 23/26 e-Bupot page to import a CSV file that contains a list of your electronic withholding certificates.

You can make changes to an approved e-BuPot transaction by clicking the “Change” button on the receipt you want to edit.

If you want to cancel the approved PPh 23/26 withholding slip, click “Choose an Option” then click “Delete the Withholding Receipt”. Then, the status of the proof of deduction will change to draft.