- Products

- Solutions

- By use case

- By industry

- Pricing

- Resources

- Company

Personal Annual Tax Return (SPT) reporting at OnlinePajak is completely free! The only thing you have to pay is your taxes, only if you underpay.

Report your taxes with OnlinePajak and get instant proof of reporting from DJP.

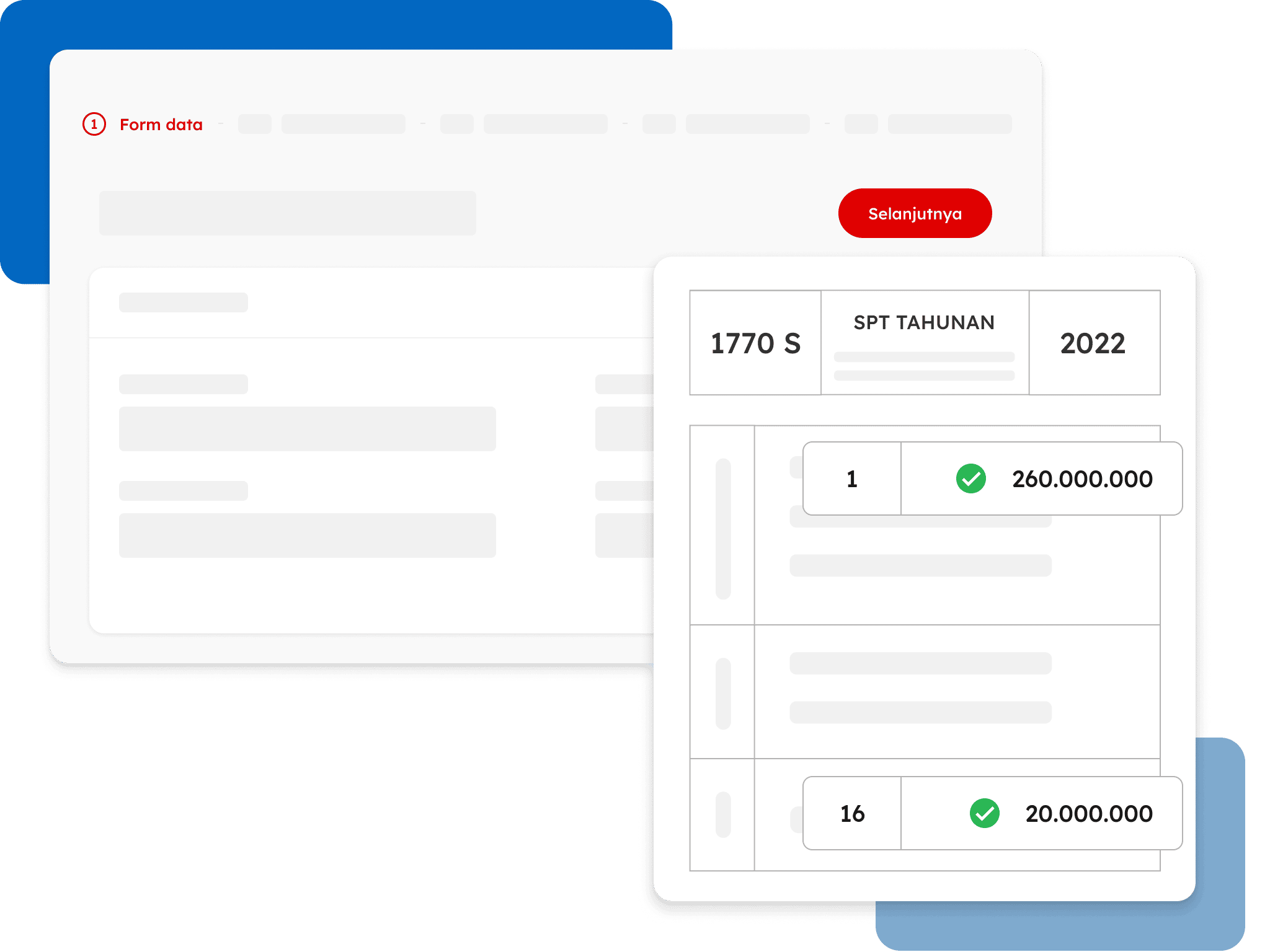

Our automatic calculations minimize the occurrence of ‘human error’. You also don’t need to worry about technical problems, because our automatic calculations are adjusted to the latest tax regulations.

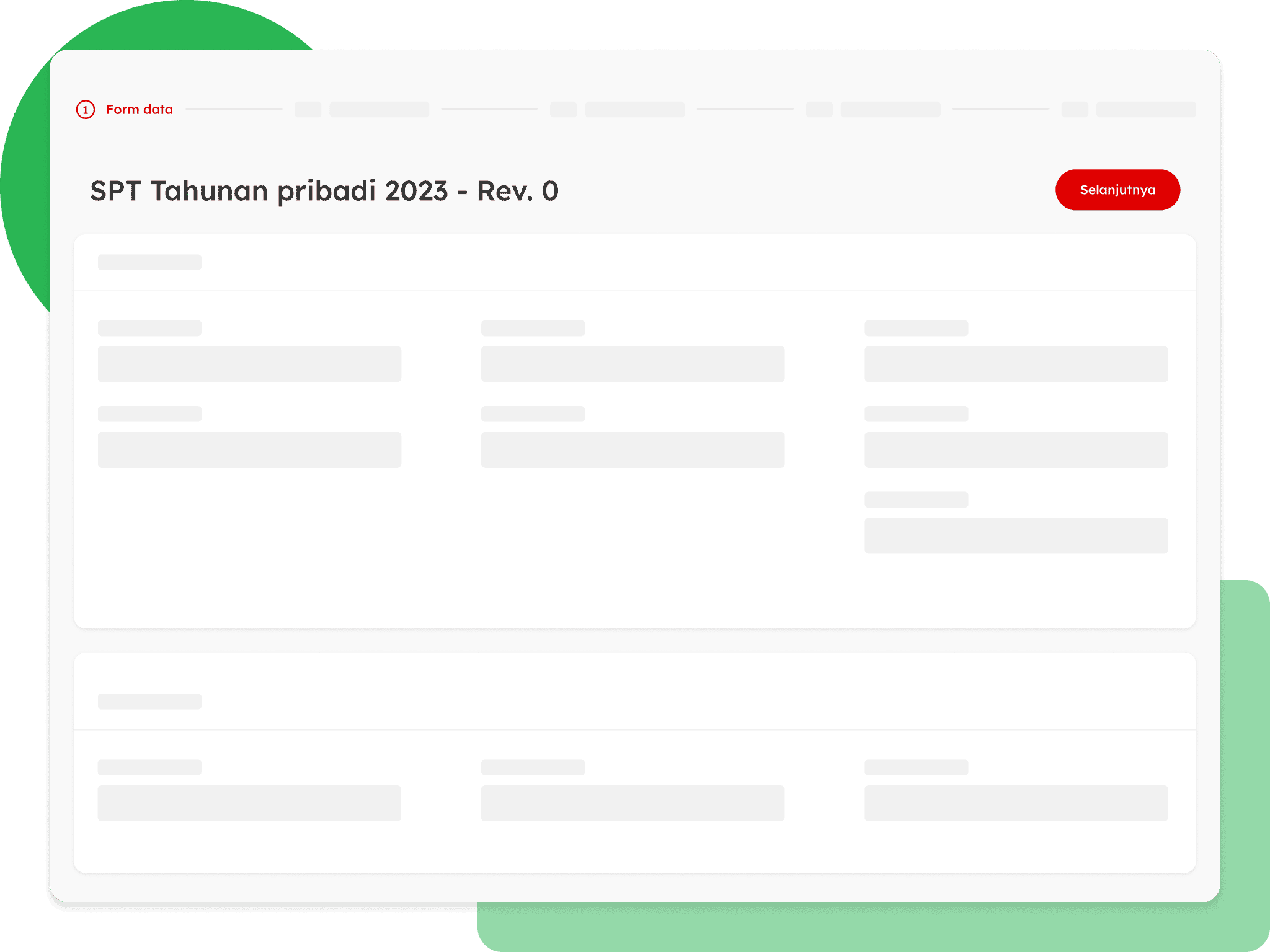

Easy-to-navigate online web application with a comprehensive interface. No need to install anything, you can access from anywhere, anytime.

Apply for an electronic certificate online or manually. Prepare your passphrase, KTP/KITAS, original appointment letter if represented, etc. Don’t forget to get your queue number online first kunjungpajak.go.id.

Login to the OnlinePajak website. Click “Information” and complete your profile by selecting “Change”. Enter the NPWP, digital certificate, and passphrase. Next, click “Make Annual SPT”. Choose your job, click “Start Making Annual SPT”, select “Tax Year” and “Click Next Step”. Fill in all the required data and click “Save SPT”.

SPT Form/Form 1770 S/Form 1770 SS from the employer. So, if it’s almost time to report your Personal Annual SPT on March 31, you can ask your employer and do the reporting via e-Filing OnlinePajak’s Personal Annual Tax Return (SPT).