- Products

- Solutions

- By use case

- By industry

- Pricing

- Resources

- Company

Sudden audit requests can lead to an exhausting document collection process, numerous email exchanges, and the possibility of missing documents. Moreover, most companies need to be made aware of the risks of audits around transaction compliance.

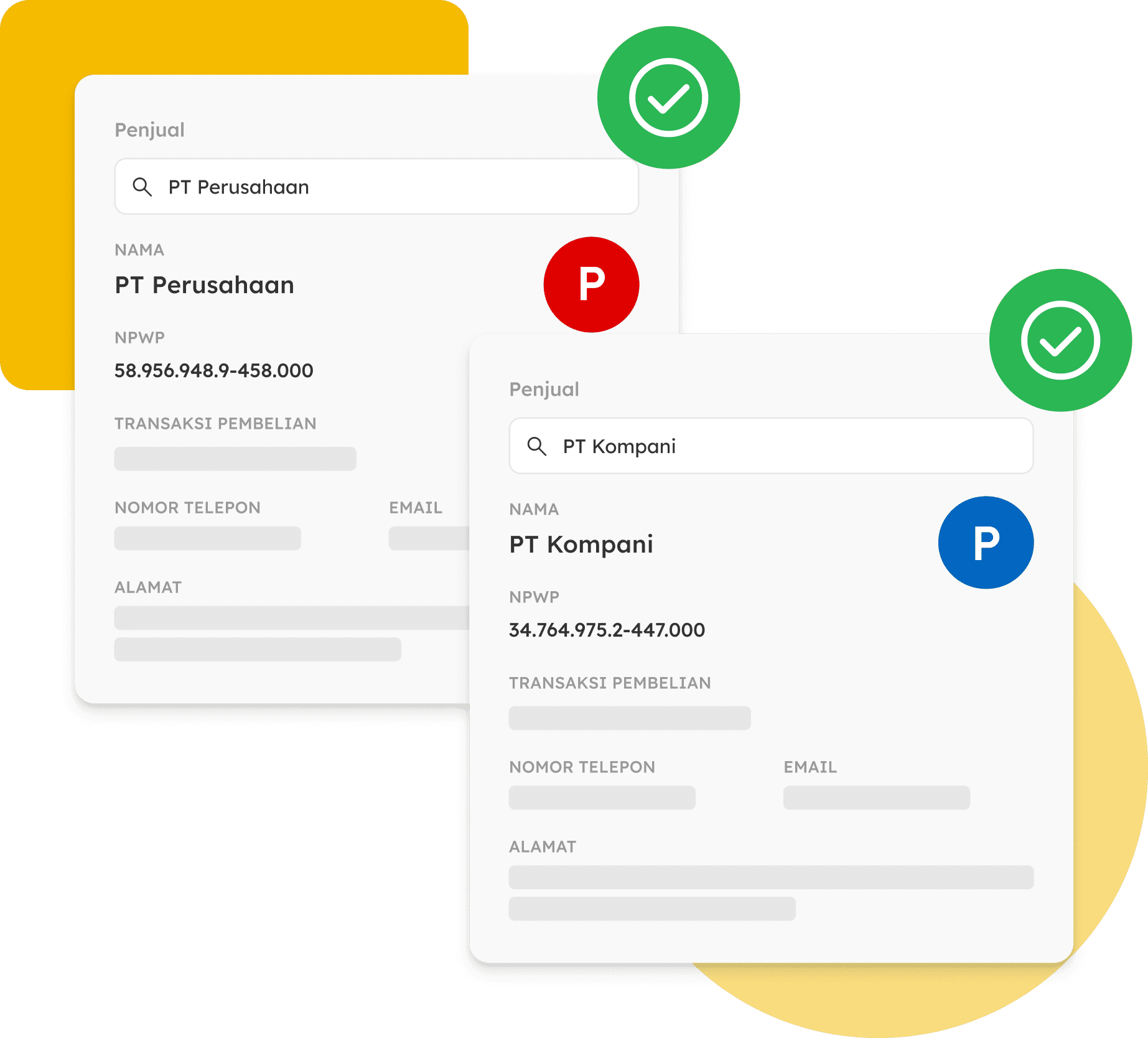

Minimize inaccuracy of transactions with our official master data feature, which allows companies to obtain the correct tax details of their vendors to ensure utmost compliance with tax and finance regulations.

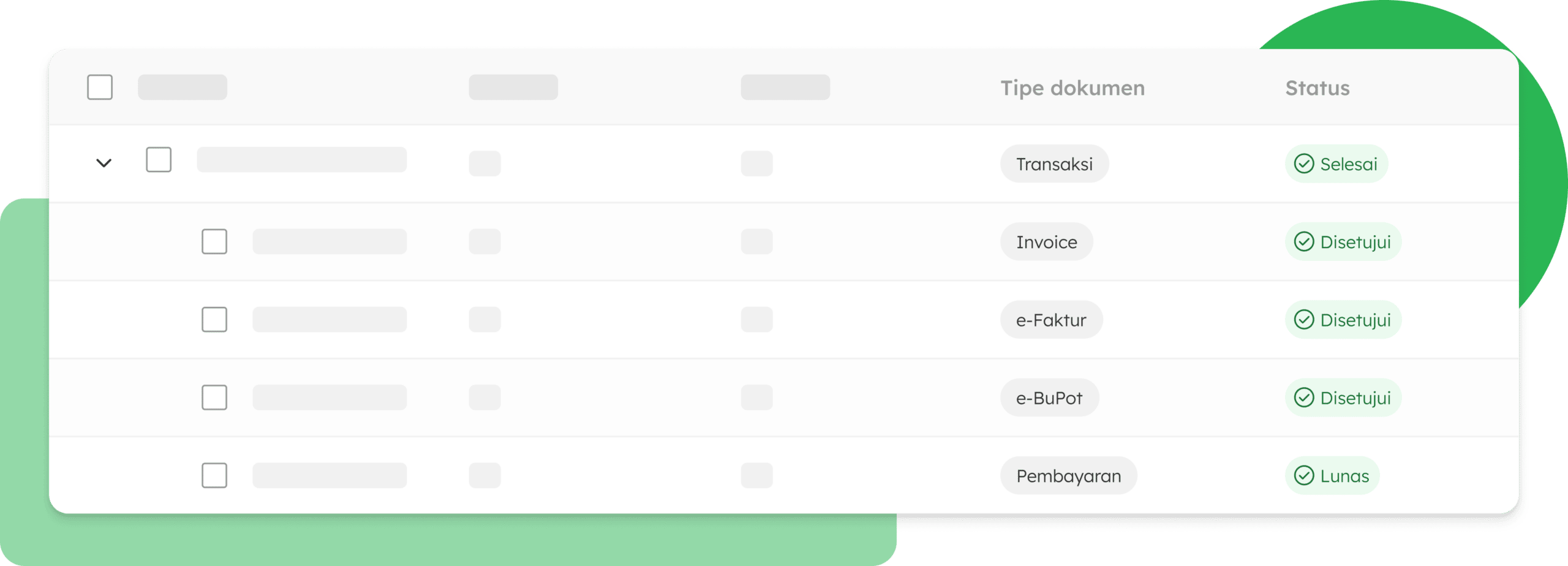

You can find related documents and transactions needed for any audit with a simple click. Every detail can be accessed in a single platform, allowing convenient transaction reconciliation.

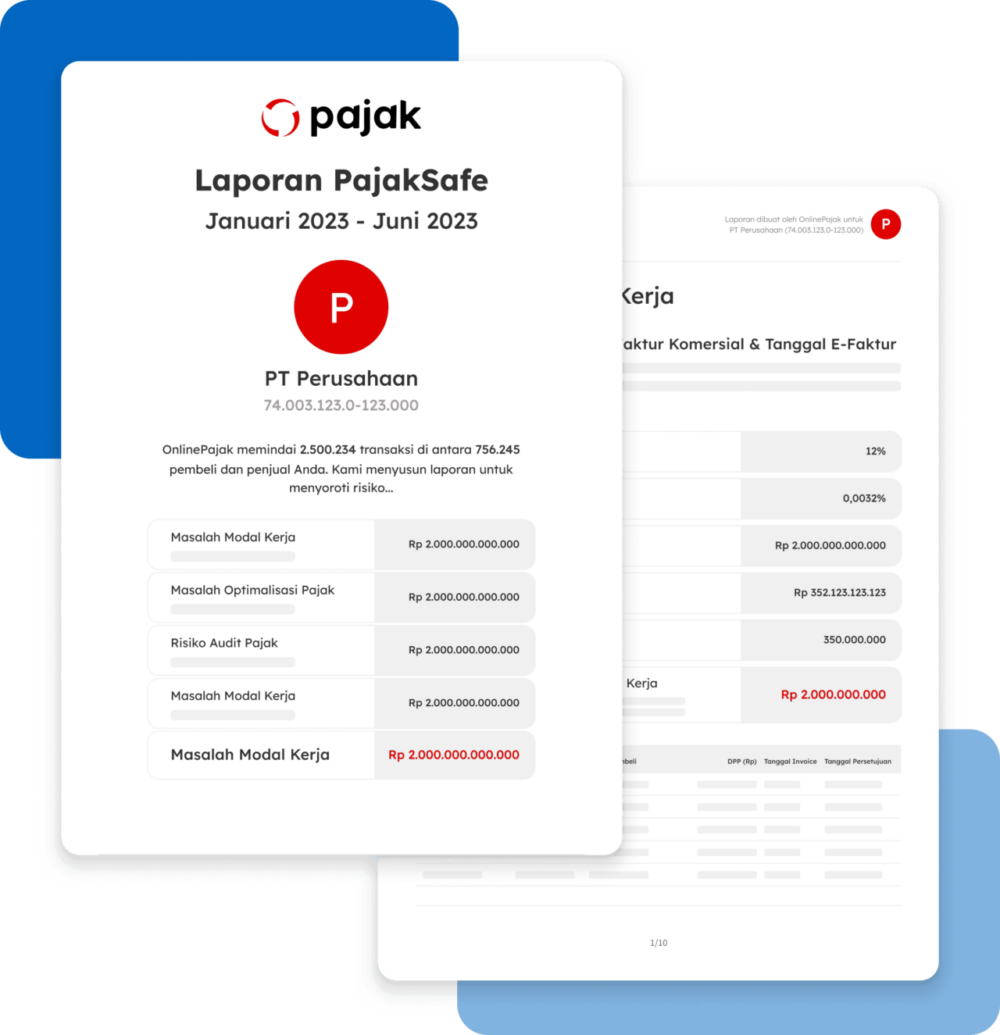

Our PajakSafe feature will run a thorough report to find out which transactions need attention, especially ones that do not comply with the rules.