- Products

- Solutions

- By use case

- By industry

- Pricing

- Resources

- Company

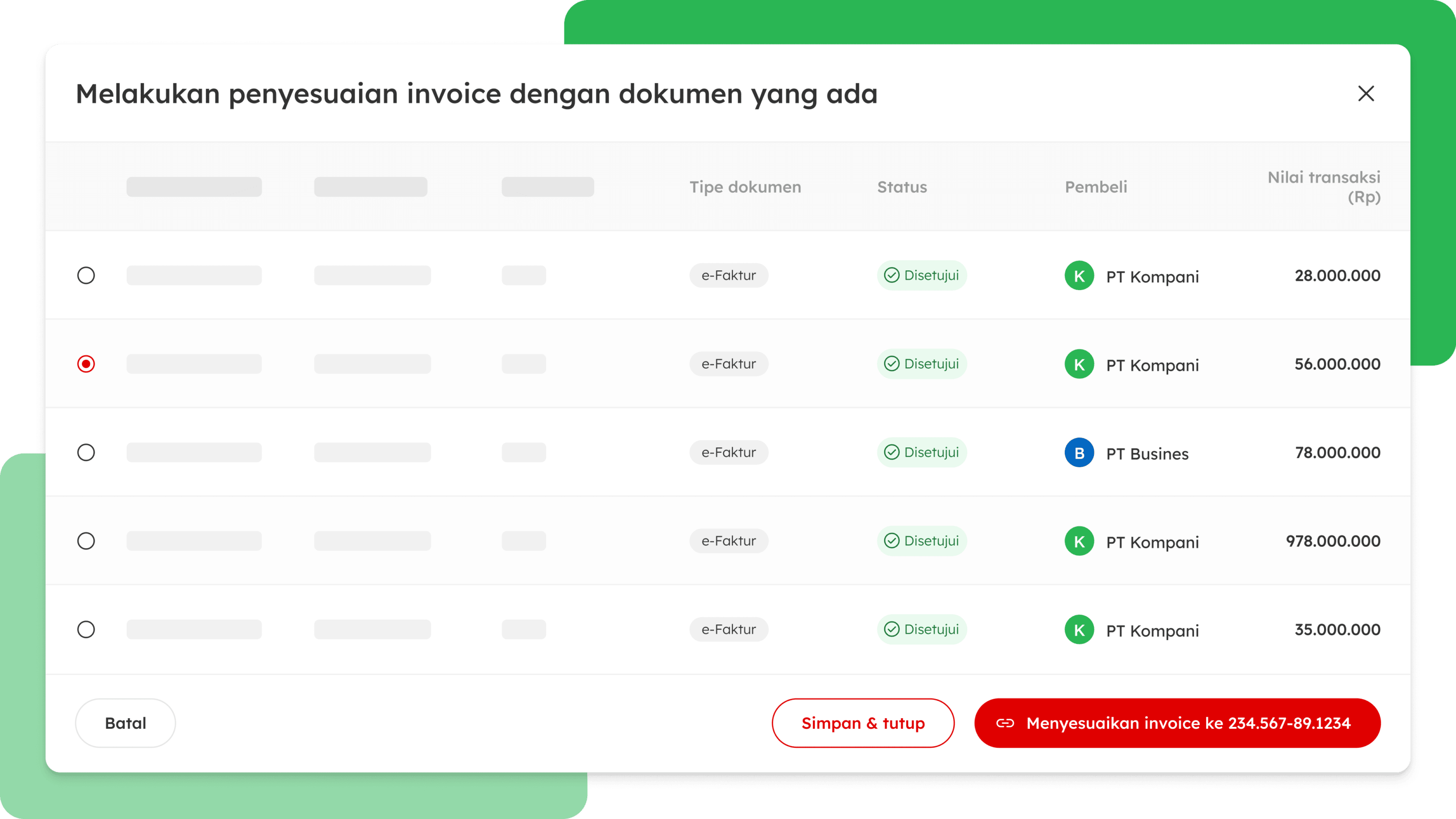

You can reconcile immediately between your sales and e-Faktur by mapping each sales invoice to their e-Faktur. Invoicing is done right with no discrepancy between commercial and tax.

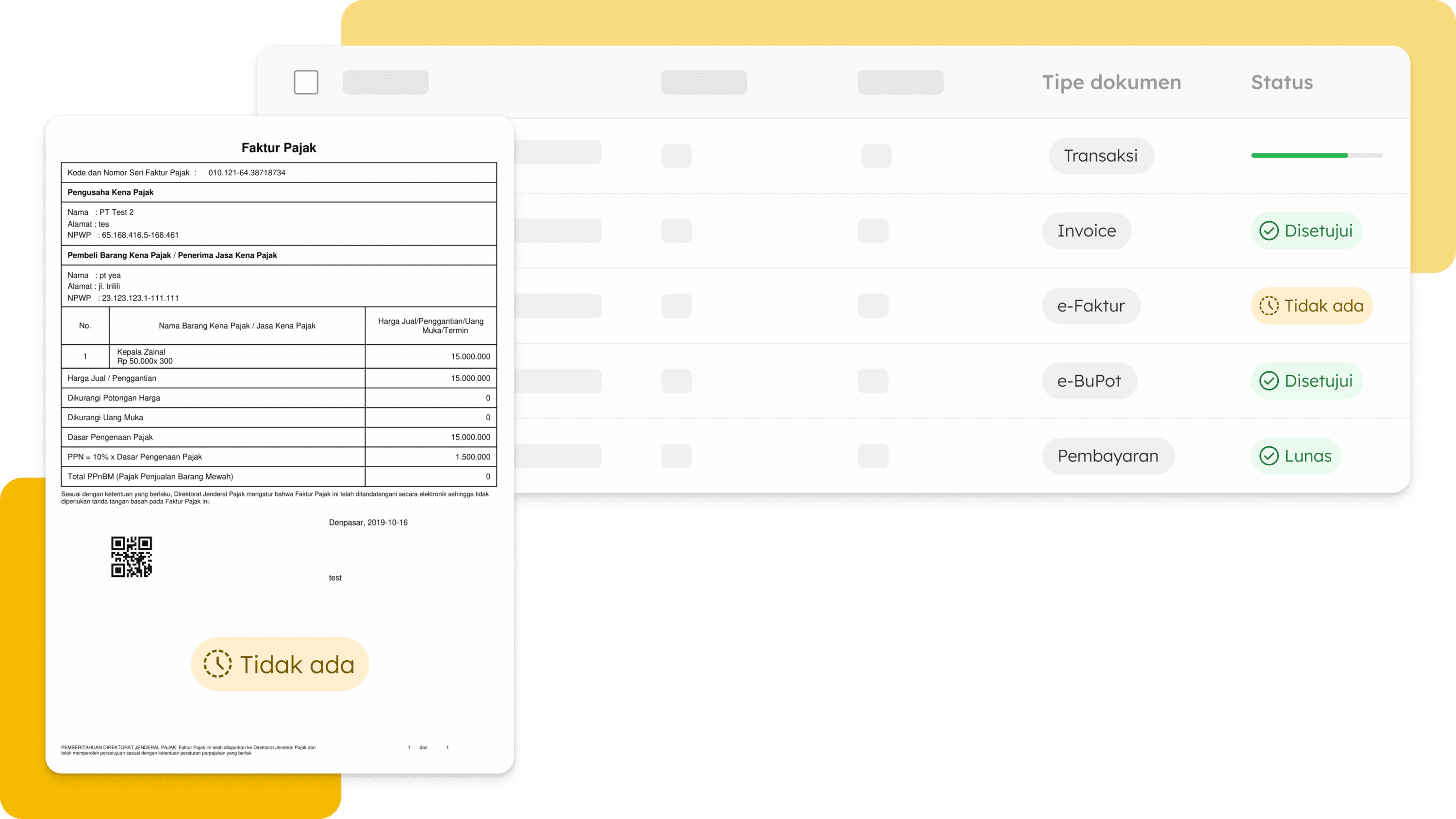

Immediately detect invoices without e-Fakturs using our consolidated view.

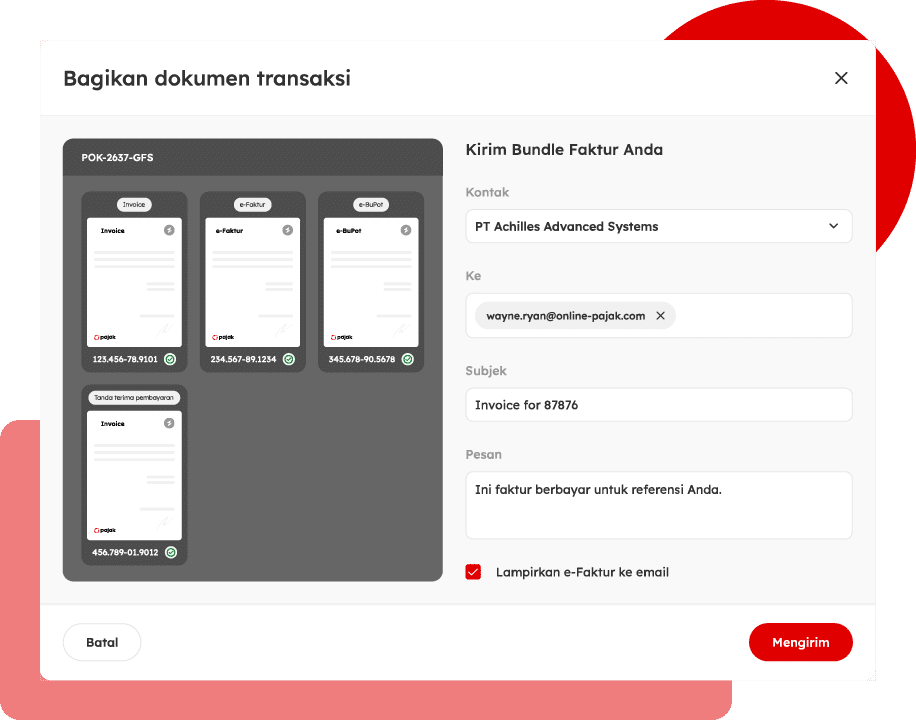

Send your invoice directly through our platform. Add up to 5 email addresses and upload additional 3 supporting documents all at once. Enjoy the easy and convenient process of sending your documents.

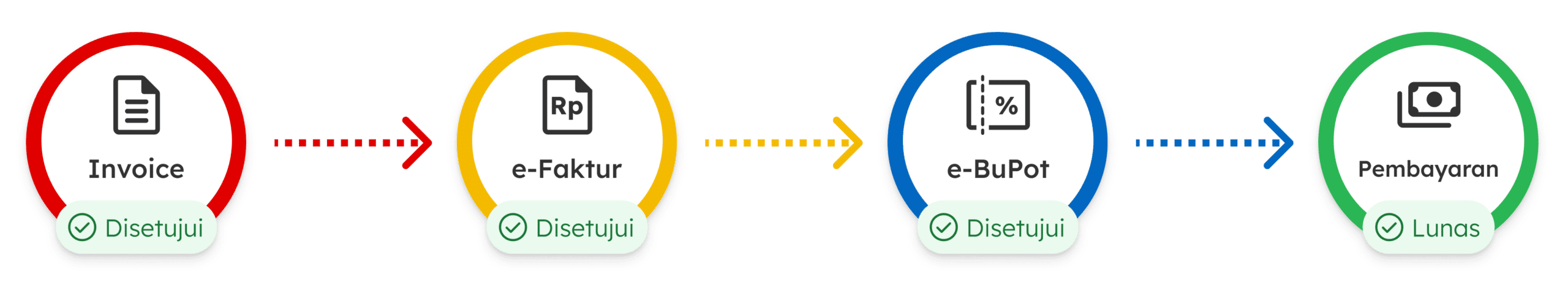

Gain complete visibility on your transaction lifecycle, from invoice creation through to e-Faktur creation, delivery to the customer, and payment confirmation.

If you don’t want to use the invoice notification email feature, click the gear icon, select “transaction settings”, select “email settings” and click “enable email automation”. Make sure the color on the menu changes from green to gray, then the feature has been successfully deactivated.

If you already have a billing code, then you can pay your input invoice directly at OnlinePajak via the available payment methods. If you don’t have a billing code yet, you can create one directly on OnlinePajak.

You can enter the VAT menu, click “purchase” and make sure the status of the invoice you want to cancel is approved. Enter some of the required return information on the screen, and click the “save and approved” button.

Prepare several supporting documents when sending invoices to transaction partners. In the VAT menu, select Sales and mark the name of the buyer to whom you will send the invoice, then click “send email”. Don’t forget to attach supporting documents in the “attach” column and click “submit”.

You can quickly send an e–Invoice as a PDF to customers when your tax invoice is approved. To do this, go to the Transaction menu. Select the invoice you want to send. Fill in the information that corresponds to the transaction data and then press the send button.