- Products

- Solutions

- By use case

- By industry

- Pricing

- Resources

- Company

You can upload your e-Filing csv for multiple NPWP in one go. Each e-Filing CSV will be distributed to each NPWP account. Simply select the CSV file you want to process from the uploader page.

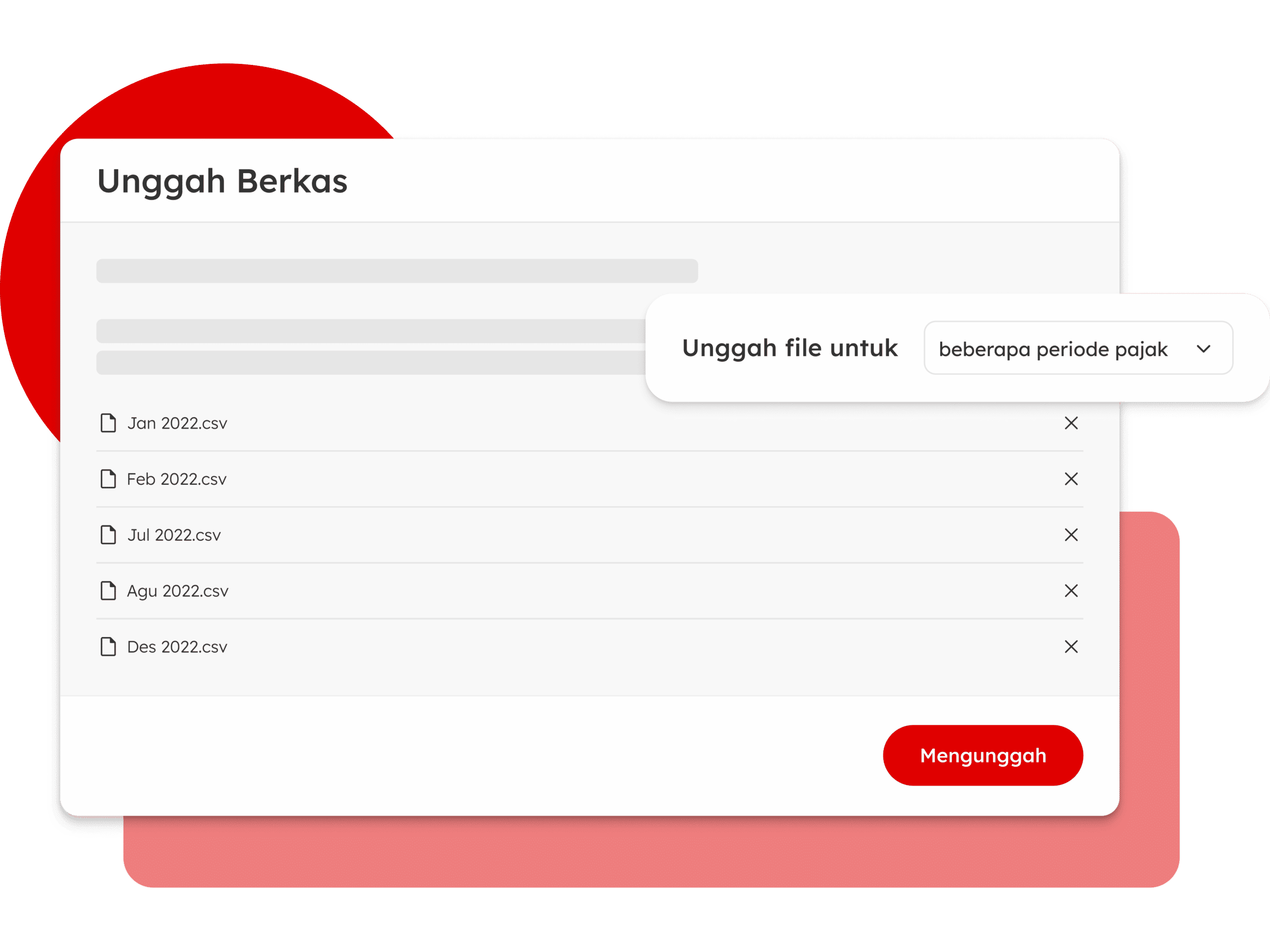

You can upload your e-Filing csv for multiple tax periods in one go. Each e-Filing CSV will be distributed to each tax period. Simply select the CSV file you want to process from the uploader page.

Enter the “Transaction” menu and click “SPT Masa”. Then, select the type of tax that you want to report then click “Create SPT Masa”.

You can report taxes for all company branches in just 1 click. Enter the “Tax Report” menu, then click “Upload File”. Select all CSV and PDF files, then click “View Tax”.

You can view your e-Filing reporting history in the “Tax Report” menu. Please select the “Tax Period” you wish to view. You can also download the BPE for your tax returns.