- Products

- Solutions

- By use case

- By industry

- Pricing

- Resources

- Company

As an official partner DJP, we provide up-to-date e-Faktur services following DJP application updates.

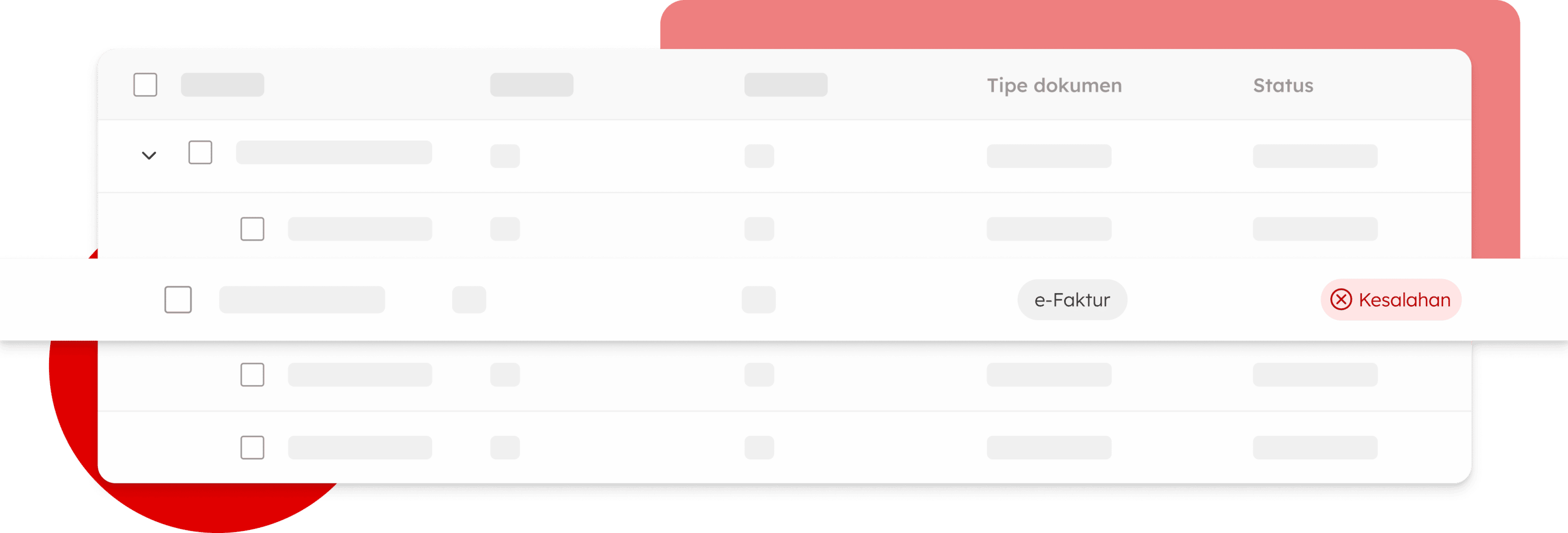

e-Faktur will be generated automatically once you create an invoice. Also, enjoy the feature to instantly detect invoices without e-Invoices using our integrated view.

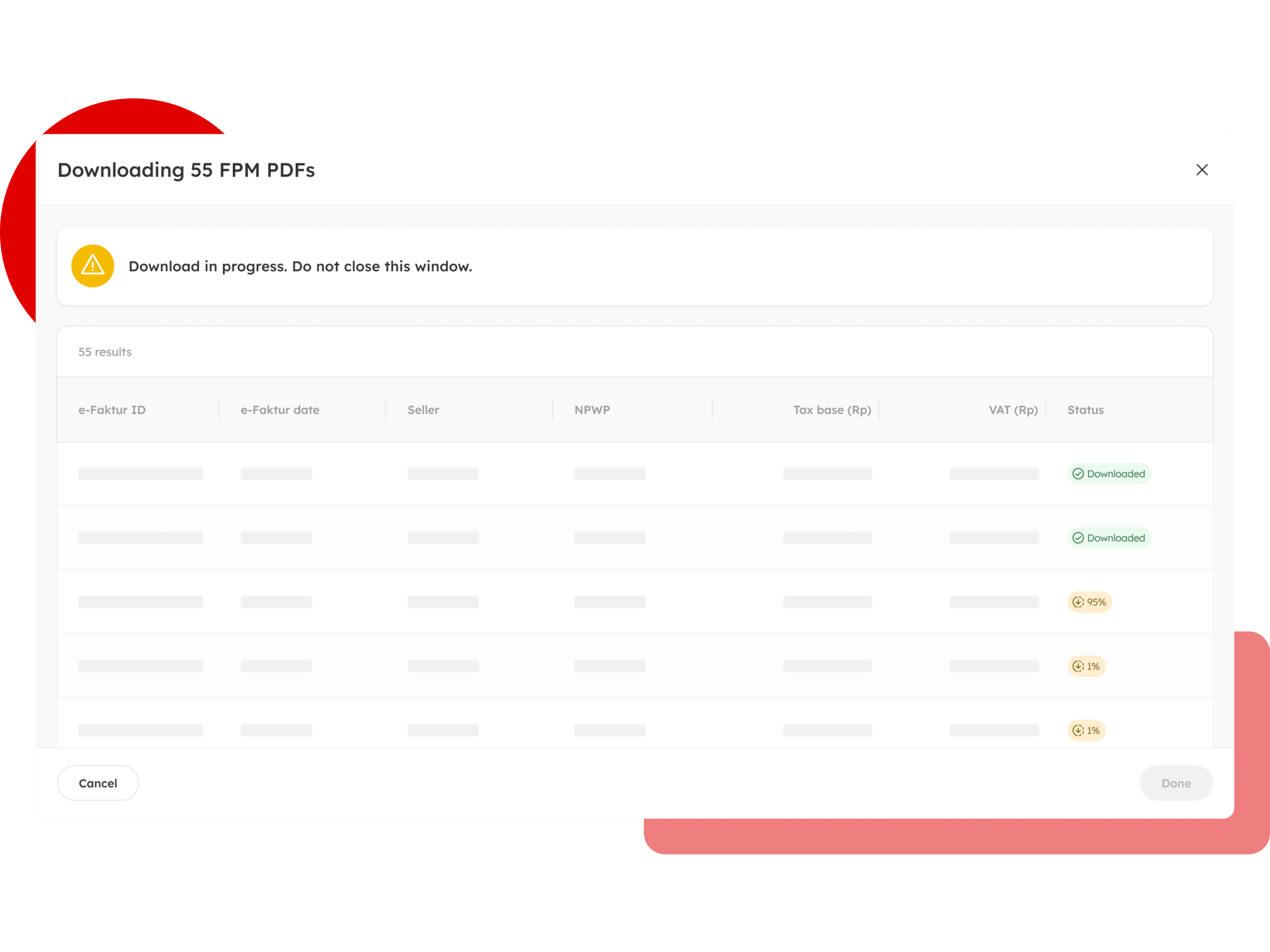

Improve your productivity by directly downloading the PDF Faktur Pajak Masukan as soon as the supplier approves them and automate your Nomor Seri Faktur Pajak (NSFP) allocation in our platform.

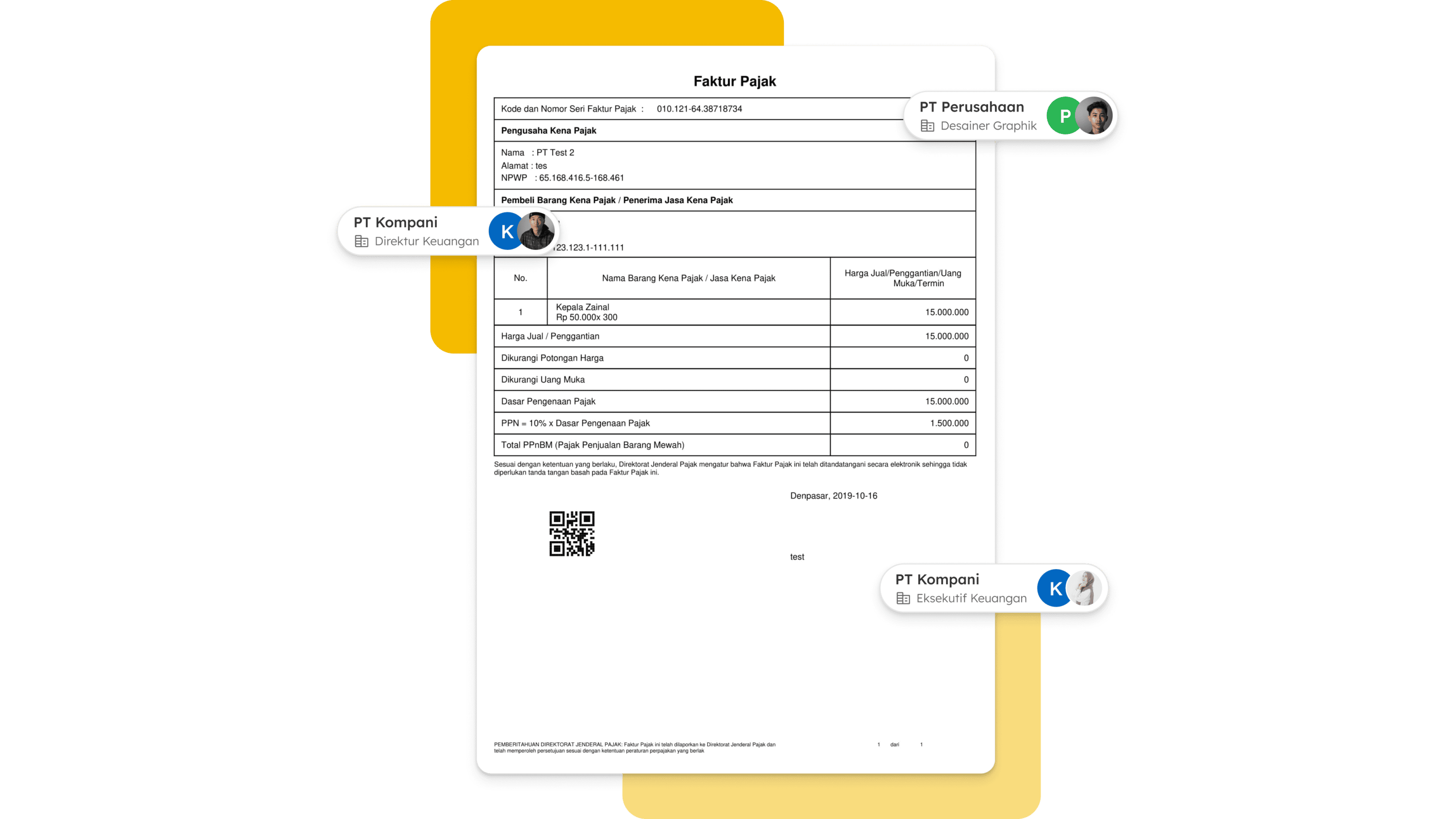

You can manage e-Faktur for multiple companies together with various users at the same time. Our roles and permissions allow further collaboration between your team members.

The OnlinePajak e-Faktur service helps taxpayers, especially Taxable Entrepreneurs (PKP) in managing their electronic tax invoices. Starting from making, correcting, canceling, and paying, to reporting. This service is officially supervised by DGT and security is guaranteed.

You can easily download e-Invoice PDF documents by simply going to the Transactions menu and selecting the Sales tab, then clicking VAT. Checklist the invoice you want and click Download PDF e-Faktur.

You only need a few minutes to create/validate a PDF e-Faktur via OnlinePajak. However, if the DGT e-Faktur service is in a high-traffic condition, then we will process it until it is successful. Once successful, we will confirm via your email registered with OnlinePajak.

The main preparation is to complete the forms and requirements, one of which is an electronic certificate. Visit the KPP to submit an Electronic Certificate Application letter. Next, don’t forget to activate your account immediately.

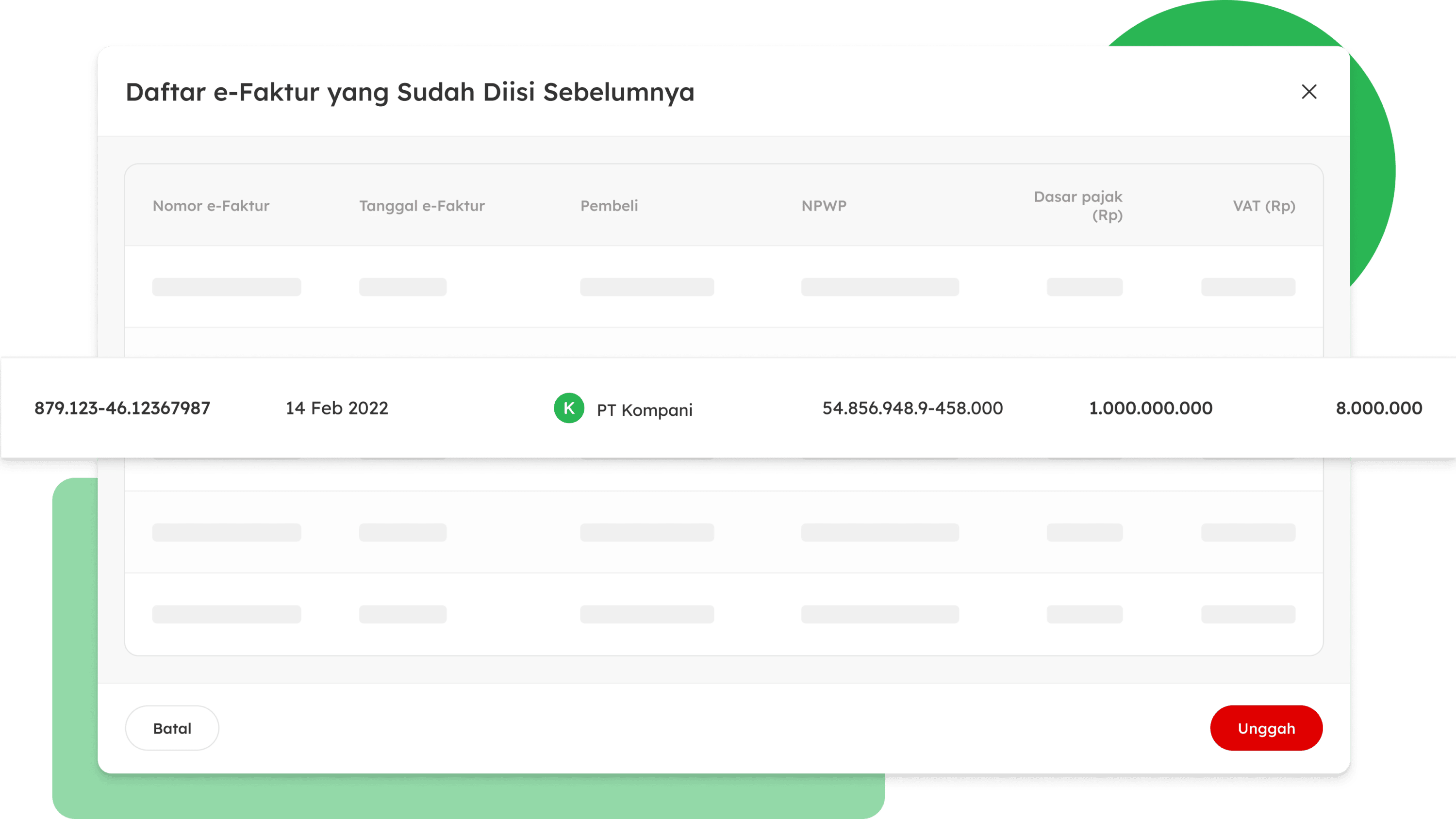

You can import all your tax invoices from the DGT e-Faktur application to the OnlinePajak application. On the “Transaction” menu, click the “+ Add” button then select “Import Tax Invoice”. Next, upload the CSV file containing your tax invoice data to OnlinePajak.