- Products

- Solutions

- By use case

- By industry

- Pricing

- Resources

- Company

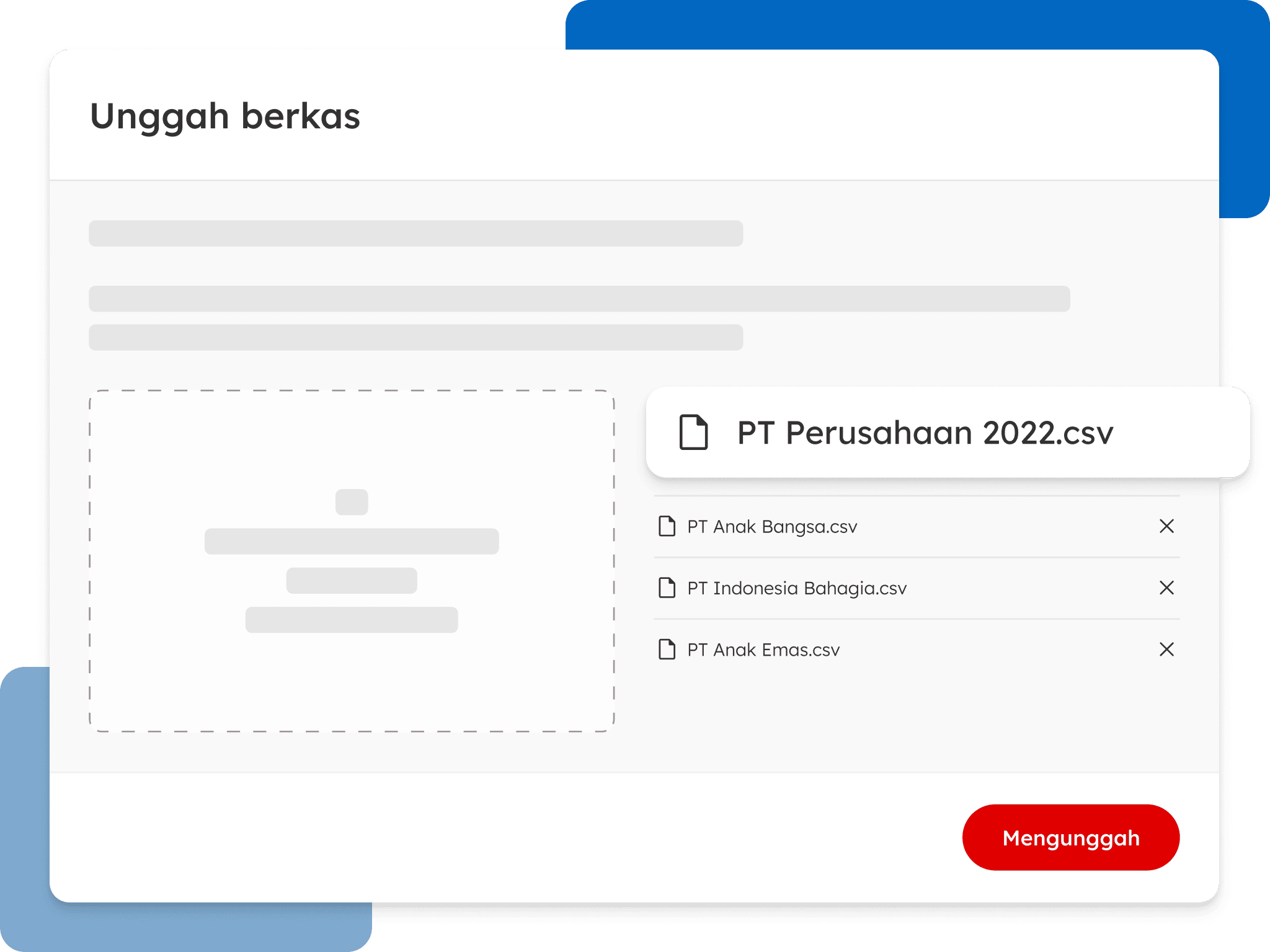

More reliable import CSV feature that can accept much more data in one import.

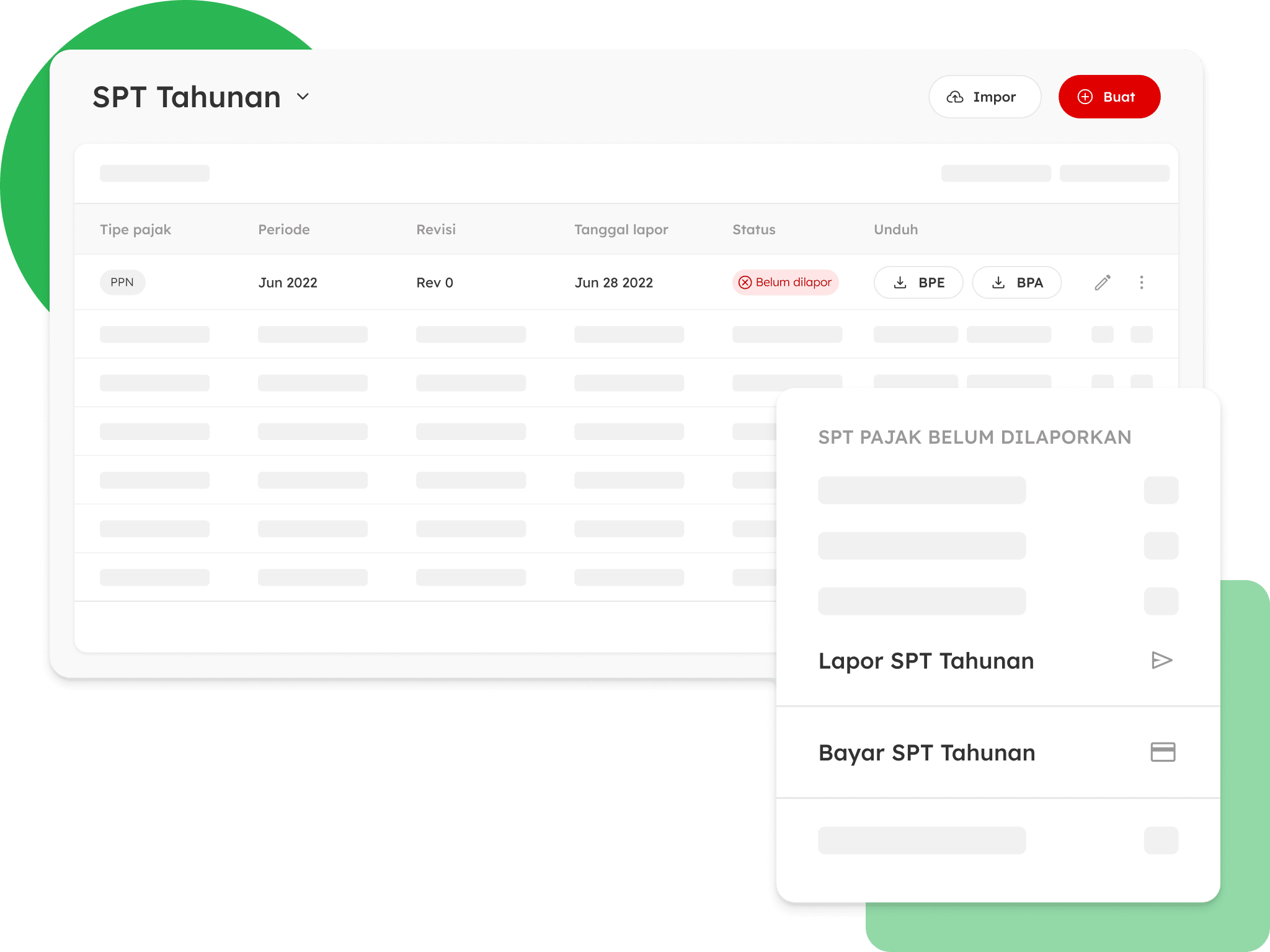

Not only preparing SPT, our platform allows to proceed the end-to-end from prepare to pay & file without leaving the platform.

Activate your e-Fin so you can report taxes at OnlinePajak. Click the “Gear” icon to enter the “e-Fin Settings” menu, then complete your company’s e-Fin number and follow the instructions provided.

Make sure you have prepared all documents for the purpose of reporting the Annual Corporate Tax Return. Then, create and fill in SPT 1771 in the OnlinePajak application. Follow the instructions provided and fill in the information fields truthfully.

If the Annual SPT reporting is successful, you can download the Electronic Receipt (BPE). Enter the “Tax Report” menu, then select the Tax Period and click the “Download BPE” icon to download your BPE.